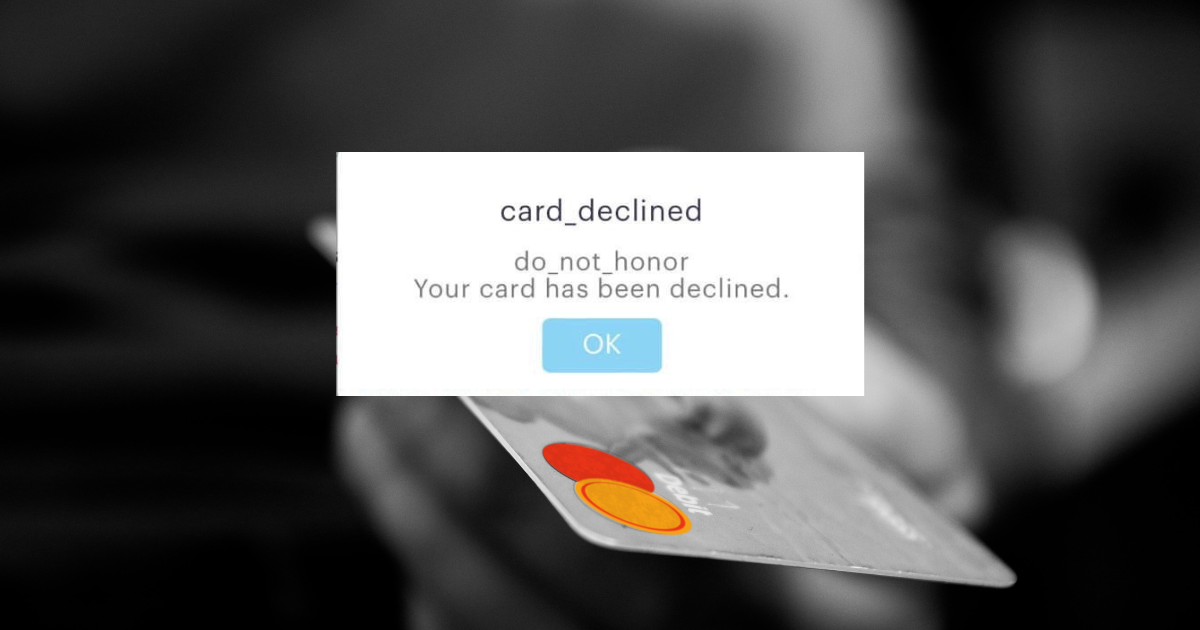

You could notice a number of rejected payments with the explanation "005: Do Not Honour" when browsing through your payment date. This can explain a lot of unsuccessful transactions, but what does it actually mean?

Even though the response is not always apparent, we'll walk you through what "Do Not Honour" on a credit card can imply for you.

Let’s understand what Credit Card “Do Not Honour” mean?

Simply put, the "Do Not Honour" notification implies that the issuing bank of the customer's card will not allow a transaction to just go ahead. In other words, the customer's credit card has been refused by the issuing bank.

However, this can happen for a variety of reasons. The following are the primary causes:

Inadequate funding

"Do Not Honour" is often synonymous with "Inadequate Funds." Because some issuers and processors simply fail to send the right refusal message, "Do Not Honor" is provided as the default message.

Credential Discrepancy

What are credentials in terms of credit cards? It refers to credit card information that a customer has opted to save to a merchant's web server in order to make future purchases more convenient. Data commonly includes billing name, billing address, card account number, and card expiration date. Any mismatch in any of this information, while making a transaction, leads to a denied authorization. And, because there is no standard denial message, issuers utilise the default reason: "Do Not Honour."

Possible Fraud

If not for a credential mismatch or insufficient funds, its probably because there has been unusual activity on a card that may be an indication of fraud.

The issuer will determine what constitutes suspicious behaviour. The most obvious explanation is that a card has been reported either lost or stolen. However, there are additional causes for why a bank can decide to proceed cautiously. The customer's card has been placed on hold because the transaction was flagged by the issuing bank's anti-fraud system for any reason. This could be an unusually large purchase or a purchase made with a strange combination of factors (late at night, multiple orders within close proximity, etc.), multiple denied payments on the card in a row, so the card has been locked until the customer contacts the bank, the card is being used in a different country than the customer's bank is, are a few examples. Issuers prefer to be on the lookout for suspicious transactions and reject them. The merchant will receive a "Do Not Honour" notification when this happens.

In few cases, issuers may display the notice "59: Suspected Fraud." they often instantly translate it as "Do Not Honour." This prevents any awkward circumstances, forming between a vendor and a customer.

What to do in case of a do not honour credit card transaction?

There are several alternatives. Customers will typically try the transaction again, which is reasonable, but it is unlikely to have much of an impact on "do not honour" denials.

If that doesn't work, your basic options could be, you can request your customer to use a different card, or that they wait a few hours and try again. You can also propose that the customer call or contact their bank to inform them of the transaction, especially if it is taking place outside of the country where the customer's bank is situated.

There aren't many possibilities outside those, and you'll almost certainly never learn why the transaction returned a Do Not Honour code.

.png)

.jpg)